Clarus’ Strategic Allocation Strategies are a series of strategically managed, risk-targeted portfolios designed to provide broad diversification across all major asset classes, style-boxes, and regions.

Broad-Based Exposure with a Tilt towards Leadership

The Strategic Allocation Series portfolios offer a low minimum entry point for access to strategic, broad-based asset allocation models. Clarus managers strive to add alpha via fund selection and asset allocation tilting while maintaining a risk-targeted approach. The portfolios are broadly diversified via the use of ETFs and mutual funds, aiming to capture exposure to all major asset classes, style-boxes, and regions of the market. Allocation tilting allows Clarus managers to incorporate additional exposure to market leadership to help drive alpha.

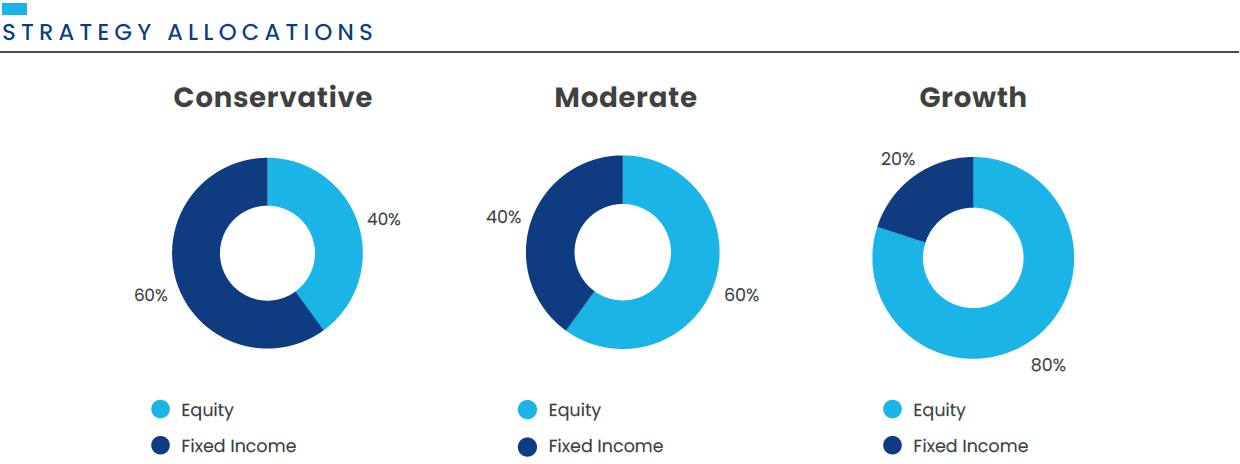

Risk-Targeted Strategic Allocation Offerings:

- Conservative

- Moderate

- Growth

GIPS Verified Performance

Clarus investment management returns have been independently audited and verified under GIPS standards for the periods December 31, 2016, through December 31, 2024.

Fact Sheets with updated performance and the GIPS verification report is available upon request.