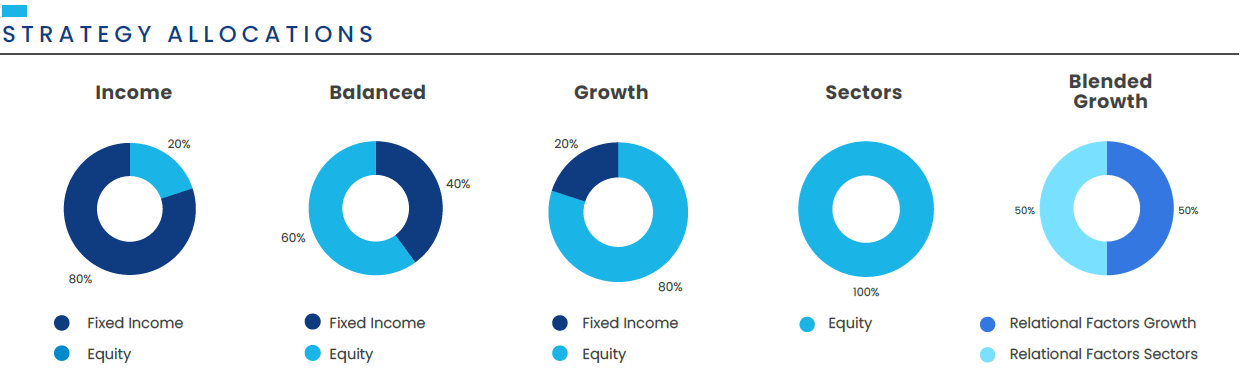

Clarus’ Relational Factor Strategies offer a unique take on the strategic allocation management style. The portfolio construction process focuses on identifying positive relational opportunities and relative valuation assessment of the primary asset classes. The main objective of the series is to seek positive, risk-adjusted returns over market cycles.

Flexible Options for Varying Risk Profiles

In addition to risk-targeted Income, Balanced, and Growth portfolios, the Relational Factors approach also incorporates a sector-focused methodology which aims to capture alpha by taking advantage of relative valuations between sectors. We also offer a blended option, combining both Growth and Sectors at an even split.

Risk-targeted Relational Factor Portfolio Offerings:

- Income

- Balanced

- Growth

- Sectors

- Blended Growth

GIPS Verified Performance

Clarus investment management returns have been independently audited and verified under GIPS standards for the periods December 31, 2016, through December 31, 2024.

Fact Sheets with updated performance and the GIPS verification report is available upon request.