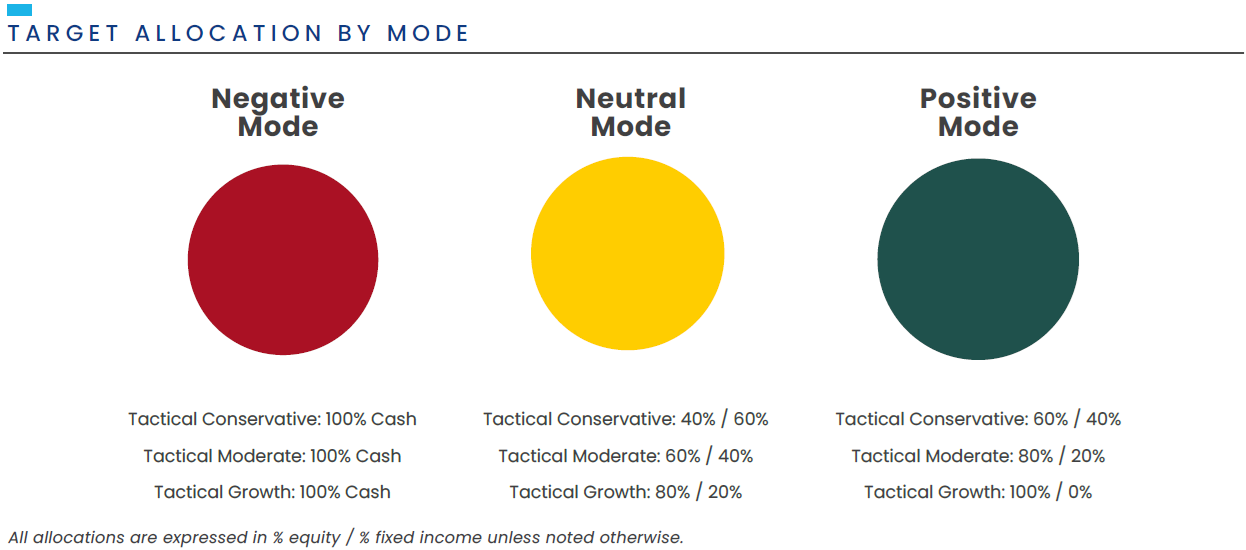

Clarus’ Tactical Allocation Strategies are a series of longer-term, risk managed portfolios designed to keep allocations in sync with the primary market cycles. The goal is to position portfolios to participate in market advances during positive cycles while striving to minimize the impact of severely negative environments.

The Goal: Stay In Sync With Primary Market Cycles

The Tactical Allocation Strategies adjust exposure to market risk based on the conditions of the market’s primary market environment.

Risk-Targeted Tactical Allocation Offerings:

- Conservative

- Moderate

- Growth

GIPS Verified Performance

Clarus investment management returns have been independently audited and verified under GIPS standards for the periods December 31, 2016, through December 31, 2024.

Fact Sheets with updated performance and the GIPS verification report is available upon request.